You are considering a career as an accountant or finance professional. Before you make the choice, be sure to read this article for an overview of the differences between the two fields. It will discuss the Job responsibilities for each field as well as the education requirements. We'll also touch on the outlook for both fields. So, get started reading! You'll be grateful you did. Now you're able to make an educated decision about your future career.

Your job responsibilities

If you are a business student, it is possible to consider a degree in finance or accountancy. Both are on the rise, and both will see a 5% increase in employment over the next five-years. Accounting professionals are responsible for managing financial records and preparing tax returns. Accounting and finance professionals both analyze company finances in order to spot potential growth patterns. It doesn't matter if your goal is to become an accountant or a finance professional. Make sure you understand the differences and similarities.

Both fields require solid financial management knowledge, but each job has its own responsibilities. Accounting professionals are responsible in tracking every dollar spent within a company, creating financial reports and communicating these decisions to top management. Finance professionals also create multiple reports and must have excellent English skills. Qualified applicants will be attracted to a well-written accounting job description. The description can be used to recruit more experienced members of your staff.

Career paths

You can make a good living by handling money and finance is a good career choice. These areas have great potential for growth. Consider your personality traits, interests and goals before you choose a career path. These professions can also prove to be extremely rewarding. These are just some of the many finance jobs you have. There are many advancement opportunities for all of them. These are the advantages of a career within finance and accounting.

A bachelor's level in finance can give you a greater understanding of the field, and a solid foundation for a future career. Graduates with a master's degrees in finance can work in a variety of financial roles. An MBA in finance can be pursued by graduates. This advanced degree will give them a thorough business education. After you graduate, it is possible to go on to manage your career.

Education requirements

Accounting and finance education requirements differ. Finance degrees are typically focused on helping people achieve their financial goals. Although accountants are more concerned with financial statements, finance degrees can be helpful in preparing for the CPA exam. Both fields require heavy coursework and can lead to lucrative careers. Here are some similarities and differences between these two fields. Learn more. Here are some of the key differences between finance and accounting.

The major differences between finance & accounting are the courses taken and the required practical skills. Accounting professionals tend to have a more stable job, while finance majors can be more flexible and make changes in their career. Finance degrees give them a deeper understanding of finance management and greater influence in the development of company financial strategies. However, both majors work closely with financial statements. They may also use the information to forecast future performance.

Job outlook

It can be confusing to choose between a career within finance or accounting when you are just getting started in the workforce. It's important that you understand the differences between the fields to ensure you are able to choose the right one for yourself. Here are some of the key differences and similarities as well as their job outlook. Both fields will continue to grow, but there are major differences.

While accounting and finance share many jobs, both professions require different skills. Accounting professionals focus on creating and analyzing financial statements. Finance professionals, however, use historical financial data to predict the future. You must also be able to think ahead, since reports may be years or months old. Because these two fields require different personalities, they need to have different traits. Here are the most important corporate jobs in finance and accounting.

FAQ

How long does it usually take to become a certified accountant?

Passing the CPA examination is essential to becoming an accountant. Most people who want to become accountants study for about 4 years before they sit for the exam.

After passing the exam, you must work at least three years as an associate to become a certified public accountant (CPA).

What is the difference in accounting and bookkeeping?

Accounting is the study and analysis of financial transactions. The recording of these transactions is called bookkeeping.

Both are connected, but they are distinct activities.

Accounting deals primarily using numbers, while bookskeeping deals primarily dealing with people.

To report on the financial health of an organization, bookkeepers must keep track of financial information.

They ensure all books balance by correcting entries in accounts payable and accounts receivable.

Accountants examine financial statements in order to determine whether they conform with generally accepted accounting practices (GAAP).

If not, they may recommend changes to GAAP.

For accountants to be able to analyze the data, bookkeepers must keep track of financial transactions.

What should I expect from an accountant when I hire them?

When hiring an accountant, ask questions about their experience, qualifications, and references.

It is important to find someone who has done this before, and who knows what he/she's doing.

Ask them if they have any special skills or knowledge that would be helpful to you.

Look for people who are trustworthy in your community.

What is an auditor?

Auditors look for inconsistencies between financial statements and actual events.

He ensures that the figures provided are accurate.

He also checks the validity of financial statements.

What is an audit?

An audit involves a review and analysis of a company's financial statements. Auditors examine the company's books to verify everything is correct.

Auditors look for discrepancies between what was reported and what actually happened.

They also ensure that financial statements have been prepared correctly.

Statistics

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

Accounting for Small Business

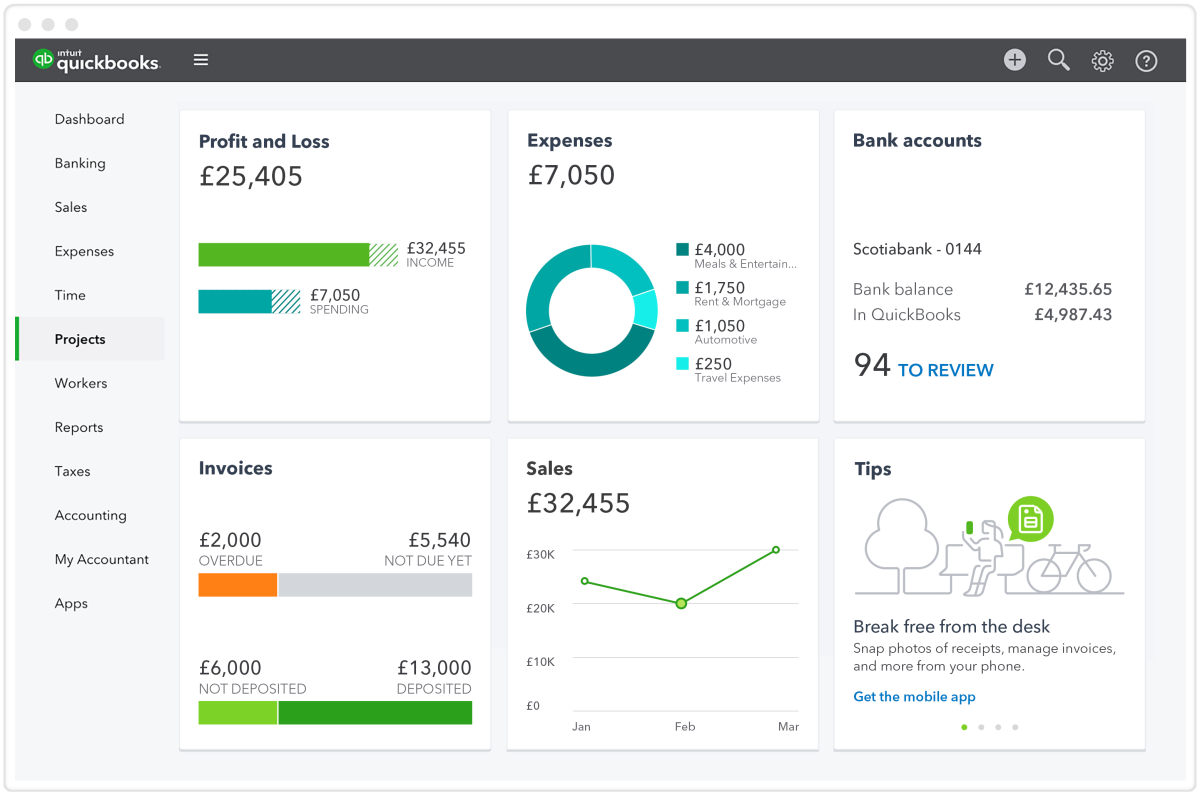

Accounting for small businesses should be one of your most important tasks when managing a business. Accounting involves keeping track of income, expenses, creating financial reports and paying taxes. It also involves the use of various software programs such as Quickbooks Online. There are many options for accounting small businesses. You should choose the best way for you according to your needs. Below are the top choices.

-

The paper accounting method is recommended. If you want to keep things simple, then using paper accounting may work well for you. This method is very simple. All you need to do is keep track of all transactions. If you are looking to ensure that your records are accurate and complete, you may want to consider QuickBooks Online.

-

Online accounting. Online accounting is a way to have easy access to your accounts no matter where you are. Wave Systems, Freshbooks, Xero and Freshbooks are some of the most popular options. These software can be used to manage your finances, pay bills and send invoices. You can also generate reports. These programs offer many features and benefits. They also make it easy to use. So if you want to save time and money when it comes to accounting, you should definitely try out these programs.

-

Use cloud accounting. Another option you have is cloud accounting. It allows data to be securely stored on a remote server. Cloud accounting offers many benefits over traditional accounting systems. Cloud accounting isn't dependent on expensive software or hardware. Second, it offers better security because all your information is stored remotely. It takes the worry out of backups. It makes it easy to share files with others.

-

Use bookkeeping software. Bookkeeping software is similar to cloud accounting, but it requires you to purchase a computer and install the software on it. Once you have installed the software, the software will allow you to connect to the Internet so you can access your accounts whenever it suits you. You will also be able view your balance sheets and accounts directly from your computer.

-

Use spreadsheets. Spreadsheets can be used to manually enter financial transactions. One example is a spreadsheet you can use to track your daily sales. You can also make changes whenever you like without needing to update the whole document.

-

Use a cash book. A cashbook records all transactions that you make. Cashbooks can come in different sizes depending on how much space is available. Either keep a separate notebook each month, or you can use one notebook that covers multiple months.

-

Use a check register. A check register can be used to organize receipts, payments, and other information. All you need to do is scan the items received into your scanner, and you can transfer them to your check register. Notes can be added to the items once they are scanned.

-

Use a journal. A journal is a type logbook that tracks your expenses. This is especially useful if you have frequent recurring expenses such rent, utilities, and insurance.

-

Use a diary. You can simply use a diary to keep track of your life. You can use it as a way to keep track and plan your spending habits.